Four decades ago, when I was studying for my Iowa driver’s license, the booklet from the Department of Motor Vehicles made an emphatic point: Driving is a privilege, not a right. That same principle applies to the latest stunt from the Religious Right.

An organization called the Alliance Defense Fund, a coalition of right-wing evangelicals with ties to James Dobson of Focus on the Family, proposed a mass protest of sorts for Sunday, September 28. This group claims that the Internal Revenue Service ban on partisan political activity for tax-exempt organizations represents a denial of constitutional rights. They want pastors to be able to endorse specific candidates from the pulpit without losing their churches’ tax exemptions, and to press the point, they have designated September 28 as the day of mass defiance. On that Sunday, pastors sympathetic with the Alliance Defense Fund are to make their political endorsements. The plan is that the IRS would investigate the matter and enforce the law, whereupon these aggrieved pastors would take their case all the way to the (presumably sympathetic) Supreme Court.

The organizers are calling it “Pulpit Freedom Sunday.”

“For so long, there has been this cloud of intimidation over the church,” Alliance attorney Erik Stanley told the Washington Post. “It is the job of the pastors of America to debate the proper role of church in society. It’s not for the government to mandate the role of church in society.”

This argument, however, ignores a crucial point: Tax exemption amounts to public subsidy. The protection from taxation—corporate taxes, property taxes, sales taxes—represents, in fact, an extraordinarily generous accommodation to religious and other charitable organizations, a gift that is compounded by the fact that individual contributions to such groups allow taxpayers to reap the benefit of reducing their own taxes. The effect is that both the immediate community and the rest of society have to make up the difference. When a church or synagogue or other not-for-profit organization, for example, purchases a plot of land for the construction of a new building, that land typically comes off of the property tax rolls. The city or township then has to find a way to make up the difference, either through the reduction of services or the raising of taxes. The same principle applies to corporate taxes and sales taxes.

I’m not arguing here against these tax exemptions, although such arguments are credible. The founders believed that voluntary associations in the new nation were a good thing and ought to be encouraged; that argument is explicit in the Federalist Papers and is at least implicit in the Constitution itself. The exemption from taxation followed from that logic. Acting squarely within its prerogative, Congress decided in 1954 that, in exchange for these public subsidies, organizations claiming exemption from taxation should not be allowed to engage in overtly partisan activity. Congress sought to ensure that taxpayers would not be obliged to subsidize politicking.

Exemption from taxes, in other words, is a privilege, not a right. And most such organizations have seen this as a pretty good deal—as indeed it is.

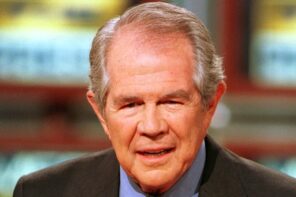

Just to be clear, a pastor (or anyone else) has every right as an individual to engage in political activity—and even to run for political office, as Pat Robertson, Jesse Jackson and Mike Huckabee have done in recent decades. But that does not mean that they can engage in partisan politicking from the pulpit. If these ministers want to do so, fine. But they must recognize that the price for doing so is the surrender of their public subsidies.

Exemption from taxation is a privilege, not a right.