Man’s extremity is God’s opportunity. In the midst of good times, many people usually forget God. But many now see the folly of it all, and are ready to hear what God has to say about things.

— E. F. Scarborough, Mississippi Methodist, December 1931*

The Great Recovery is a grassroots movement spread by people who are tired of looking to Washington for answers. The truth is that the government can’t fix this economy. It’ll be restored one family at a time, as each of us takes a stand to return to God and grandma’s way of handling money.

—from Dave Ramsey’s The Great Recovery website

The Great Recovery for an economy stalled with lingering high unemployment and stagnant income growth starts with acknowledging the Great Mistake of the New Deal, Christian megastar financial advisor Dave Ramsey told a rapt audience last Thursday evening in Nashville. “Socialists” mistakenly believe FDR got us out of the Depression while “capitalists” know it was actually World War Two, he explained in a synopsis ripped from the Tea Party/Beck/Barton school of historical interpretation.

FDR, Ramsey continued, had listened to John Maynard Keynes instead of Adam Smith, or God, and from that point forward Americans started down a path from self-reliance to a dependence on government, and the tyranny that comes with that: “The problem is, we shifted to saying that government, not God, is our provider,” he said. (In fact, influenced far more by his own persistent fiscal conservatism than by Keynes’ economic theories, FDR ordered major cutbacks in the federal budget after the 1936 election, resulting in a sharp economic downturn, akin to the “Great Recession,” in 1937-38.).

Ramsey didn’t detail the entirety of God’s Plan for Recovery during the relatively short pep talk to the live and virtual congregation, but his perfectly-pitched talk did skillfully blend a pollyannaish optimism with echoes of perennial American Christian calls for personal and national “spiritual revival.” This message has its origins in a pastiche; not only of 19th-century Christian economic preaching ranging from Charles Finney, Henry Ward Beecher, and Russell Conwell (of “Acres of Diamonds” fame), but also to 20th-century thought like Prosperity Gospel and Christian Reconstructionist economics. (Which is not to say that Ramsey is a Christian Reconstructionist; he is not. But elements of his ideas, such as his liberal use of the word “socialist” to describe any advocate of even modest government intervention, clearly overlap with Reconstructionists’—and, ironically, with anti-Christian Randians too as embodied by Atlas Shrugged anti-government hero John Galt). These traditions differ on many points but all share a belief in godly self-reliance and a loathing for anything that smacks of collective responsibility, concerns for growing inequality of income and wealth, and any call for a strengthened social safety net.

Bigger Than Suze

Ramsey’s outgoing, down-home personality has enabled him to empathize with financial distressed callers to his radio program, catapulting him from a local Nashville radio personality to the 6th- or 7th-ranked nationally syndicated radio show (below Limbaugh and Hannity, but above better-known personalities from Laura Ingraham to Glenn Beck). He has, rather quietly, become a national phenomenon. Though only a minor celebrity compared to more outlandish personalities like Beck, Ramsey has now risen to the top tier and continues rising, adding stations and listeners while others are in decline. The financial crash of 2008 was particularly good for his business and his expanding national reputation.

While other popular financial talk shows (Clark Howard, for example) instruct listeners on the proper use of credit cards and how to manage reasonable levels of debt, Ramsey’s plan is based on the principle that God abhors debt while rewarding the investor who emulates the tortoise rather than the hare. He scorns get-rich-quick schemes, and assures listeners that after getting out of debt permanently and cutting up all your credit cards, long-term equity investing is the route to tremendous wealth. Financial analysts have dissected and shredded his dubious claim that investors should expect 12% annualized returns on average in perpetuity in mutual fund investing. But while finance geeks poo-poo his plans, Ramsey responds with some variant of the classic retort: if you’re so smart, why aren’t you rich like me?

Ramsey’s daily radio show is dominated by callers, usually in some financial distress or conflict, seeking advice, intermingled with the answers to the callers’ financial problems in the form of “scriptures of the day,” frequent political rants, arguments with his critics, live radio and television simulcasts on Fox News shows like Neil Cavuto’s Your World, and personal testimonies about the wonders of how his plan will transform individual lives. Callers frequently either testify to, or are directed to, Ramsey’s “Financial Peace University” program, which instructs people in the same seven-step “debt snowball” principles outlined more fully in the Total Money Makeover book.

Ramsey’s personal financial advice empire also comes from years on the speaking circuit, where he typically draws large crowds, filling arenas of 8,000–10,000, who come to hear his engaging personal story of becoming rich as a real estate investor in his 20s, losing everything, and starting over to build wealth God’s way. In personal appearances and on the radio show Ramsey dispenses financial advice, Christian bromides, and political zingers to crowds who laugh appreciably at his folksie aphorisms: “act your wage”; “you’re paying a stupid tax”; “the borrower is always slave to the lender”; and so on.

In addition to the radio program and public appearances Ramsey now has a large, age-graded, and ever-expanding product line, including numerous versions of his books, a catalog of Ramsey swag, and a program targeted at K-12 schools (actually used in a few thousand schools nationally); his book The Total Money Makeover, in various editions now, is a fixture on the New York Times bestseller list; and personal financial blogs frequently discuss the relative merits of his seven-step “debt snowball” plan to get out and stay out of debt and thus gradually become wealthy.

Putting the whole package together, Ramsey should be understood as far more influential than better known financial gurus like Suze Orman, while the friendly tone of his broadcasts gives him an audience who might normally avoid the harder-edged radio rants of a Limbaugh or Hannity, or the conspiracy-mongering of Beck.

An Invitation to the Tea Party: John Galt, Meet Jesus Christ

In the “Great Recovery” webcast, Ramsey shied away from any political labels for his economic nostrums, in spite of the fact that, as previously explained, they derive directly from a lengthy tradition of conservative Protestant economic thinking and feed directly into the Tea Party’s answers for America’s economic problems. He claims his answers are neither “conservative” nor “liberal”; they are God’s answers. In his view, regardless of whether you are a “capitalist” or a “socialist,” a conservative or a liberal, self-reliance, not government reliance, is the key, since “when you handle your money God’s ways, it will change your life.”

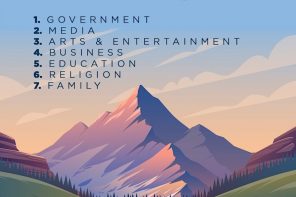

If we follow God’s plan, as explained with liberal quotations from the Book of Proverbs and any number of recent self-help authors, then and only then will we rebuild the wealth of our nation and recover from an economic downturn that was driven by a negative and biased media in the first place. And only then, after a national revival and an awakening to self-reliance, will God work his plan to help others—not through our governing institutions, but through our religious institutions and our personal giving.

“What if a whole country started handling money God’s ways,” Ramsey asked his audience rhetorically. God’s ways would not include, for example, Social Security, since God would not want to invest for the long-term at such a modest rate of return (hence his advice to “opt out” of the Social Security system when you legally can do so). God’s ways don’t include progressive taxation, since God desires us to emulate the habits of the wealthy. And God’s ways do not countenance government engaging in the “theft” of economic resources (taxation) that we have worked for and are rightfully ours. God’s ways involve no government schemes towards the common good, for God commands individuals to help themselves that they might then help others privately and voluntarily. God’s plan, in short, is the libertarian plan mixed with Christian self-restraint; for capitalism without morality is anarchy.

Much of this is standard-issue conservative economic script, of course. But to this familiar story, Ramsey adds his theology, giving divine imprimatur to a particular and historically bound set of ideas. Wielding the Book of Proverbs and Zig Ziglar, where others might clutch their Friedrich Von Hayek or Milton Friedman, Ramsey provides a compelling theology of Tea Party national economic policy: Government spending is sinful, and arises from a national turning away from God’s ways of dealing with money; sin originated in the New Deal, the “first time in history” that people looked to the government and not to themselves for employment; and it is only the heroic efforts of private entrepreneurs, operating preferably without any government interference but with a strong Christian morality, that prevents exploitation and mandates helping others, that will restore both the spiritual and financial health of the country. John Galt, meet Jesus Christ.

Kitchen Table Economics the Answer to the Nation’s Crisis?

To the degree that he assists people in difficult situations with common-sense financial advice and solid counseling, Ramsey’s financial program and personal good will have worked well for many. Further, his denunciation of predatory payday lenders, credit card collector abuses, and megabank manipulations of consumers will be appreciated by those from across the political spectrum—including Elizabeth Warren who, though hated by the right, has nevertheless made numerous appearances on his radio show.

But many other aspects of Ramsey’s fast-growing influence give pause, particularly the implication that his “common-sense” personal financial advice translates into God’s economic policy for the nation. That darker read on Ramsey’s rhetorical reach is especially pertinent as the Tea Party Caucus in the House of Representatives engages in denial of the default crisis, demands a nearly complete dismantling of government functions beyond the military, preaches that progressive taxation is tantamount to theft, and persists in schemes to privatize all aspects of the social safety net.

Echoing the Tea Party caucus, Ramsey denies the grave implications of the debt-limit ceiling, assuring his Twitter followership that the government will still function (and who needs all those Cabinet Departments anyway?). The irony, of course, is that those who most preach “personal responsibility” seem content for the nation to renege on its own national responsibility, either on money already borrowed and spent (by rejecting any adjustment of the debt limit) or on Social Security, the program almost singlehandedly responsible for lifting the elderly from the most impoverished group in the country (as was the case before the 1930s) to the least impoverished per capita today.

But in looking at the history of conservative Protestant economic ideas, there’s less irony than continuity in Ramsey’s persona and philosophy. The “Christian” response to the Great Depressions of the nineteenth century (those following economic crashes in 1857, 1873, and 1893, to cite three examples) was to call for a spiritual revival that would lead to a “Great Recovery.”

The Christian entrepreneur George Pullman preached many of the same ideas as Ramsey in the 1890s, believing that in building his company town of Pullman, Illinois, he would treat his workers fairly and avoid strikes and lockouts. The results: the bloody and contentious Pullman Strike of 1894, when President Grover Cleveland called out the troops to deliver the mail, crush the strike, and imprison Christian Socialist leader Eugene Debs.

Then, in the early 1930s, Christian leaders again called for a Great Recovery spurred once again by a spiritual revival of individual responsibility. That Depression turned out to be so catastrophic and long-lived that even most conservative churches were relieved and glad that government had taken a much more active role in establishing a social safety net since it was clear that churches couldn’t even come close to doing so. The far right of that era, however, denounced the “socialist state” created, they believe, by the New Deal, a tradition evident in the current strain of Tea Party historical interpretation.

Dave Ramsey’s combination of personal testimony of resurrection from bankruptcy, his memorable aphorisms, Prosperity Gospel optimism, and conservative critiques of collective solutions, represents a culmination of Christian economic thought that gains popularity during times of economic calamity. God, not government, is the author of hope, he says, echoing the Mississippi Methodist who recalled his view of the approaching Great Depression [see epigraph, top]. Once discredited, even among some of the conservative Protestants with whom it found its biggest audience, that view once again has a nation of followers, thanks in part to Ramsey’s influence. In Ramsey’s world, when John Galt meets Jesus Christ perpetual prosperity and individual liberty from government tyranny lies just ahead.

*Quotation comes from Alison Collis Greene, “‘No Depression in Heaven’: Religion and Economic Crisis in Memphis and the Delta, 1929-1941,” Ph.D. dissertation, Yale University, 2010.