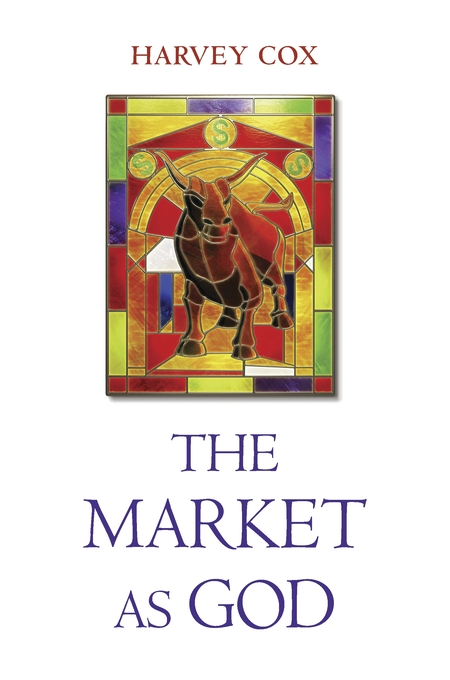

In his new book, The Market As God, theologian Harvey Cox argues that contemporary society has deified the economy. What was once the market is now The Market, an “omniscient” power that settles basic questions of meaning and value, and whose votaries—economists, bankers, traders—pursue arcane debates from a place of privilege once occupied by priests and theologians.

The 87-year-old Cox is an iconic figure in 20th century theology; he spent a half a century at Harvard Divinity School, teaching, preaching, and writing. The Market as God expands on an essay of the same name that Cox wrote for The Atlantic back in 1999.

In the book, as in the essay, Cox lays out a scathing critique of modern economics. Using religious analogies, he demonstrates the dangers of corporate personhood, limited liability, predatory lending practices, income inequality, efficient market theory, excessive advertising, Big Banks, and other familiar bugaboos.

For Cox, every economic phenomenon has its religious parallel: the advent of corporate personhood shows how economics has usurped God’s power to create. Efficient market theory highlights economists’ hubris, akin to the hubris of theologians who claimed knowledge of a perfect god. Predatory lending and deceptive advertising are like usury. Big Banks are like megachurches. We are all stuck worshipping in the corrupt Church of The Market. Cox wants to launch a Reformation.

Like Cox, I have written critically about the exaltation of economic theory. But I find the parallels offered in The Market as God to be flimsy. Many of them are clichés. Those parallels that are surprising, and that might lead to potential insight, are undermined by what the analogically inclined might call Cox’s evangelical zeal, which trades nuance for generalization, history for myth, and complicated networks of actors for an easy dichotomy of heroes and villains.

Cox is right that much economic theory has been built on a foundation of ideology, unsubstantiated claims, and outright superstition masquerading as science or Natural Law. Sometimes economic theory has been used to justify the greed of bloated financial institutions. There’s an important role for scholars of religion to play in helping unpack these problems. But here Cox has swapped in-depth analysis for the one-dimensional appeal of demonization and nostalgia.

Consider the chapter titled “Theologians and Economists.” In the world of economic theory, Cox points out, there are “rival camps” and “nasty skirmishes,” just as there are in theology. Arguments about efficient markets are like arguments over papal infallibility. The parallel is supposedly vindicated by economist and Nobel Laureate George Stigler’s book, The Economist as Preacher and Other Essays—along with a quote from an econometrics textbook in which the authors state that “much of the debate [about market efficiency] involves theological tenets that are empirically undecidable.”

But the economists-as-theologians analogy falls short of in several ways, no matter how popular it might be. If rival camps and nasty skirmishes over un-empirical first principles are what define theology, then virtually every academic discipline qualifies, along with some arguments I’ve had with my wife.

Similarly, the comparison of efficient markets to papal infallibility is too vague to do real work. Is The Market like the pope, or like God? Which market are we talking about? This latter question is particularly vexing, because Cox’s understanding of the The Market veers from one definition to another throughout the book. At times, when Cox writes about “the market,” he seems to be referring to modern capitalism writ large (though exactly how modern depends on the chapter). Other times, he means the world as seen by economists, or, even more broadly, the corrupting force of greed, wherever and whenever it occurs.

It might have helped if Cox had attended to the titular essay of Stigler’s book more closely. Cox cites the book in support of his analogy between economists and theologians. But in “The Economist as Preacher,” Stigler actually warns readers that his definition of preaching is “loose.” He then maintains that economists are generally unlike preachers. “The first, probably the most important, and possibly the most surprising thing to say about the economist preachers is that they have done very little of it,” writes Stigler. “The great economists, then, have not been preoccupied with preaching.”

Analogies aside, it’s just not clear that Cox knows much about the subject of economics. Or, if he does, he must prefer to simplify for the sake of rhetorical effect.

Here’s an example: Cox writes that “Our current rush to centralize everything, even though it is often done in the name of efficiency, is mostly carried out in an effort to increase profits.” But he provides little evidence to support this sweeping claim, does not even mention the possible benefits of centralization, and makes no acknowledgment of the possibility that, in many cases, efficiency and profit might not be mutually exclusive goals.

In most cases, the references on contentious economic issues are limited to dated examples and a few high-profile books—Piketty’s Capital in the Twenty-First Century, Akerlof and Shiller’s Phishing for Phools. This is in contrast to work like Robert Nelson’s Economics as Religion, which, along with much modern scholarship on the relationship between the two disciplines, is not noted in The Market as God. The problem is all the more striking given the book’s detailed and insightful accounts of religious history—such as the controversy between Augustine and Pelagius and the evolution of the Jubilee Year.

The Market as God, with its sweeping claims, feels less like analysis and more like a sermon on the evils of modern capitalism. Here be demons: “acolytes” of The Market, “devotees” of Adam Smith, “calculating profit seekers,” bankers in “Armani suits.” And here be saviors: Pope Francis, owners of co-ops, anyone who refuses mindless consumption and patronizes local businesses.

For many readers, myself included, Cox will be preaching to the choir. I favor more regulation of the financial industry. I hate wildly high CEO salaries, mindless consumption, and predatory lending.

But it is important not to accept a preacher’s claims just because you like the story he’s telling. Economics is an extremely complicated topic, yet throughout the book, with only a few exceptions, this complexity takes a backseat to mythic generalizations, particularly about the good old days:

- “There was a time when people spoke…of the ‘inherent worth’ of persons.” No longer, apparently—though Cox never discusses that the actual sale of people was widespread back then, and somehow ended during the age of The Market.

- “There was a time when stately hymns, chorales, and ‘Sunday-go-to-meeting’ neckties and dresses all bespoke restraint and self-control.” No longer—nowadays “the modern turn to guitars, trap drums, jeans, and sweatshirts sends, if not always consciously, a very different message.”

- Once upon a time, before The Market, “traders, buyers, and sellers all transacted their business within a nexus of assumed mutual trust, manners, and obligation.” No longer—we have traded morality for unadulterated greed.

Cox provides little evidence to support this Manichean dichotomy between past and present. Instead, the book relies largely on speculative theorizing. This is best illustrated by Cox’s treatment of the “pixel,” a sinister new vehicle for The Market spirit that “leaves a memory trail,” bypasses “our language grid” and “connects directly to the circuits that convey emotions.” Once established, “these neuro-chemical imprints are virtually impossible to erase.” Scary, yes, but the entire section has no citations, and makes no sense scientifically speaking.

Throughout his career, Cox has modeled a graceful melding of activism, academics, and pastoral engagement. This newest book stands in a long line of theological interventions in the most pressing moral problems of each successive generation. While Cox’s aim is certainly true, The Market as God misses the target.