Remember Goldman Sachs chief Lloyd Blankfein telling The Times of London that he was but a humble banker “doing God’s work”? That was back in November, and it’s possible that a few cheerleaders for turbo-capitalism still believed then that big trading houses like Goldman help to make the world go round in a God-like way. I don’t think many are saying that today, however, as it’s become clear that Goldman was willing to completely mislead scores of big institutional investors and even send the world economy into a sickening tailspin for the sake of a quick buck. Even the theologically illiterate may now doubt that God wants the world’s poorest to pay the heaviest cost for the greed and recklessness of Goldman and the rest.

I don’t know whether yesterday’s Senate hearing or the upcoming SEC fraud case against Goldman will finally expose the extent of self-dealing involved in today’s financial marketplace, but it’s possible. And maybe they will also start to expose the extent to which corrupted markets and corrupted government are intertwined problems. That seems less likely, but it is still devoutly to be wished for.

When the president went to New York last week to beard the bankers in their den, as it were, I was moved to wonder whether this trip was all theater or only half theatrical. In the days leading up to Obama’s Cooper Union speech, the White House had privately reassured the major Wall Street players that they had nothing major to fear from proposed regulatory reform. And it was clear that none of the titans in attendance last Thursday was seriously worried; you could see it in their smug faces. After all, by then they’d spent upwards of $500 million on direct lobbying to ensure that their longterm interests would be fairly well protected in whatever legislation emerges. And all the big-shot lawyers they’ve hired to represent them are government insiders, including former Obama White House counsel Gregory Craig.

This was evidence, as if more were needed, of the way members of the upper echelons in government, law, and finance defer to each other. These elegantly-attired “achievatrons” (in Lewis Lapham’s coinage) merely enact a kind of kabuki when they pretend to have a spat.

It would be good if just once in a while, the corporate media would take note of this kabuki dimension. But the media’s major talking heads have their own theatrics to attend to. Witness the chatter on CNBC, Bloomberg, and CNN over whether putting some transparency into derivatives markets, limiting highly-leveraged bets, etc., would “stifle innovation.”

To my knowledge, no one holding forth on this question ever bothered to interrogate that word innovation even a tiny little bit. Last week CNN’s unsavory Ali Velshi brandished the word as a shibboleth and accused morning anchor Tony Harris of threatening to bring down the “dynamic” US economy because sweet Tony dared to say that he longed for the old-fashioned kind of stock trading—the kind where your broker actually finds you a solid investment in a real enterprise. (Dynamic: there’s more throwaway jargon begging for interrogation.)

The innovation that Velshi and many others defend is of a very peculiar kind. It has nothing to do with inventing and marketing a better widget. It has everything to do with accelerating profits by jiggering money markets and making money move faster in various ways. Accelerating profits quite literally: the biggest and most voracious trading houses speed their way past mere mortals by using high-powered computers to execute much faster and more lucrative trades than the old-school traders can make.

Let us try, at least, to keep it somewhat real: we have always had business barons in this culture, we have always had unscrupulous tycoons, and we have always had market manipulators and connivers. But we have never had as obnoxious a bunch of weasels (many of them young) as we now have on the Street: morally deformed but mathematically adept punks who claim the right to lord it over us and block or undermine perfectly sensible and sorely-needed regulation. They claim this right because (according to them) we’re just not as bright and ambitious as they are—meaning that we drones haven’t learned to make dishonest gain for ourselves in the ways they have become almost kabbalistically schooled in doing.

Lest you think I exaggerate the sheer tenacity of these termite-like creatures in extracting wealth for themselves in antisocial ways, it turns out that they even jiggered and corrupted the ratings agencies in order to maximize their pelf during the height of the bubble. As Gretchen Morgenson and Louise Story reported in last Saturday’s New York Times, Goldman and the rest didn’t just dig deep into the factors that ratings agencies were using, they went out and hired a bunch of people directly from the agencies to help them construct the toxic junk they proceeded to peddle to credulous investors.

Give Me the Old Tycoons—the Ones with the Diamond Stickpins

Let me say a bit more about why today’s smooth operators are more loathsome than the tycoons of old.

T.J. Stiles’ prizewinning new biography of Cornelius Vanderbilt shows the old reprobate to have been driven, ruthless, and sometimes brutal in pursuit of what he wanted. But always mindful of time and chance and never pretending to be of a superior species than the people he outwitted and exploited. It is certainly true that as the 19th century developed, some of the Social Darwinists began to attribute superior achievement to superior breeding; but most sharp-elbowed 19th- and early 20th-century entrepreneurs didn’t take this any more seriously than they took the idea that their wealth was a mark of divine election. They knew that amassing wealth was simply a game they were particularly good at; they did not, for the most part, think of business success as a sign of God’s favor. Spookily pious Rockefeller, a little bit, and there were some others. But mostly, not so much; too preposterous.

Our lords of finance, on the other hand, have sealed themselves off from us beta beings to the point that, for all practical purposes, they occupy their own planet. It’s the wealth bubble, of course, but it’s also a set of deeply anti-democratic assumptions and behaviors. They don’t make any pretense at all of caring about the commonwealth; not for them the preachments against accumulation of an Andrew Carnegie (let alone the gift of libraries by the hundreds to cities large and small). Along with exotic CDOs, they have invented a new and quite brazen morality that imagines the pure extraction of wealth by means of high-speed computing to be a worthy activity for a human being. If they think of it at all, they doubtless think of taking the trouble to produce something of actual use value to be “so very 20th century.”

This, of course, is also what makes the deference and the cozy revolving-door relationships among the self-dealing termites and high-level government types so disturbing. It means that the same reptilian morality and the same sense of a special election has seeped into those whose job it is to serve the commonwealth.

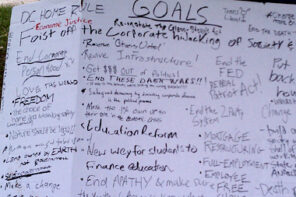

Do think about that for a moment. It’s not a pretty picture. And although I am but a drudge and a drone who never made it into this charmed circle of self-dealing, it does occur to me that a good bit of the ongoing Tea Party hoo-hah and the rapidly plummeting trust in government is tied to revulsion over this very entanglement.

That the Tea Party crowd are actually slightly more affluent than average actually points to the precise nature of this revulsion: these people feel, with some degree of justification, that they worked hard for everything they have. And they have a sneaking suspicion (warranted, as it turns out) that today’s nattily-dressed Wall Streeters and high-level politicians have been able to ride a fast track to privilege and serious money based on insider connections, access to certain schools, etc. They have a sneaking suspicion (also warranted) that these new-class elites take advantage of special tax breaks and other sweet deals even as they continue to make the rules for everyone else and even as they decide what interest rates we drones will have to pay and what level of taxation we will have to bear.

Do not expect Main Street’s visceral rage over such presumptions of privilege—and over the special moral exemptions the excessively overprivileged carve out for themselves—to subside anytime soon. And because that rage is mixed up with so much racism and anti-Semitism and identity anxiety, it could not be more dangerous.

But the answer is not to scold and patronize the angry middle the way affluent liberals tend to do. This merely fans the flames. The answer is to tear down the presumptions and the unearned privileges of the uber-class in whatever ways possible (perhaps by using “hooting derision” as one Financial Times blogger proposed) and, frankly, to punish any politician, regardless of party label, who cannot say clearly whose side he/she is on.

Oh, and that thing about God’s work? The part I remember from Sunday School is “do justice, love mercy, and walk humbly.” Did I get that wrong?